By Jim Trujillo

As an HR professional, you might read that title and think, “Duh – aren’t all retirement plans focused on employees?” Well, yes and no. As pensions have gone by the wayside and 401(k) plans have gained more notoriety, employees have become increasingly more aware of their employer sponsored retirement plans, and the financial benefits they provide.

Over the last 30 years, Defined Contribution Plans, or 401(k), plans have become a popular employer benefit option for saving for retirement. At its most basic level, a 401(k) plan allows employees to save for their personal retirement needs. But, retirement plans can vary drastically with different benefits to the employer or to the employee.

The good news is, there may be opportunity for your company’s retirement plan. Leveraging the features of your company’s retirement plan can add valuable and desirable benefits to your workforce – helping you attract and retain top talent. Here are several options you can consider to help enhance your retirement plan offering.

ELIGIBILITY

In my opinion, the first sign of a retirement plan that’s focused on its employees is one that allows for immediate eligibility. This feature allows any employee to sign up and contribute to their account as soon as they are hired.

Why is this so important? Compounding interest. Every contribution matters when saving for retirement – the longer you contribute, the more your money can grow.

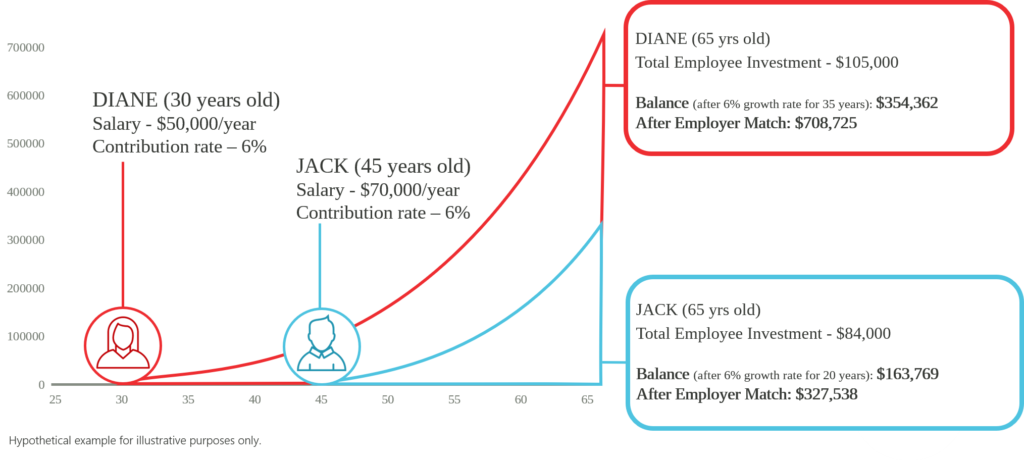

Consider this hypothetical example: Jack (45) and Diane (30) begin working at the ABC Company. Diane, a bit younger in her career, starts her salary at $50,000, and Jack enters a manager position at $70,000. ABC Co. offers a 6% match in their retirement plan, and both begin contributing immediately. Both employees intend to retire at age 65, but with very different account balances.

Hypothetical example for illustrative purposes only

The extra 15 years of contributions has allowed Diane to retire with more than double the savings of Jack, even while making less in annual salary than him. While a few months, or even a year, may not seem like a long to wait, consider the amount of money an employee can lose out on in the long term.

EMPLOYER MATCH

While the saying goes “there’s no such thing as a free lunch,” employer contribution matches are the free lunches for retirement savings. In the hypothetical example, Jack and Diane were provided a generous 6% match for their contributions. This means that for every 6% of their salary that they contribute, ABC Co. will match it. In other words, their retirement savings just doubled!

And while this all sounds great, there is a potential downside to employer contribution matches – the budget. This is an extra expense to your company’s bottom line and must be evaluated at the financial level and as part of your company’s overall employee compensation package.

FEES

Back to free lunches, like most things, retirement plans are no exception to the saying. Over the years, plan fees have adapted in different directions depending on the goal of the advisor. Unfortunately, many non-fiduciary advisors have found ways to hide their fees within the investment, making the plan appear cheaper or even free, when in fact it may not be. This is practice is called revenue sharing and the DOL has been nudging advisors and plan sponsors to avoid it because of its lack of transparency, and rightfully so! Typically, average participants struggle to fully review and understand annual fee disclosures, but with revenue sharing it can be a nearly impossible task. One way to a more transparent fee structure is zero revenue sharing investments under the guidance of a fiduciary advisor.

But what’s up with that word fiduciary? It’s everywhere! A fiduciary on a company’s retirement plan has the responsibility and the authority to make decisions on the plan and must act for the benefit of plan participants with a high standard of care. ERISA requires that each retirement plan must have a plan administrator and a named fiduciary.

One of the many duties of a fiduciary on a retirement plan is to understand the fees associated with the plan and to ensure that those fees are reasonable. The DOL suggests benchmarking your plan regularly, and it is an industry best practice to do so every 3-5 years. Through this process you will review all plan fees and services, comparing them to what else is available.

Benchmarking can uncover many details in your plan. One common occurrence is as companies grow, plans can outgrow their current fee structure. Benchmarking can help you identify overpaid fees, providing you leverage to negotiate fee reductions, or if necessary, a change in vendors.

ROTH VS TRADITIONAL OPTIONS

The age-old participant question: should I save Pre-tax or Roth? As a retirement plan advisor this is by far the most common questions I get and because of that we always spend a good deal of time educating employees on this. You may be surprised, or not, to hear that some plans don’t even offer the Roth option. But really, what is the difference?

The key between a Traditional or Roth 401(k) boils down to when the participant will pay taxes. A good rule of thumb is the younger you are, the more beneficial a Roth 401(k) can be. This is because younger investors are typically in lower income tax brackets. Paying taxes now with a tax-free withdrawal in retirement tends to be more beneficial than taking the up-front tax deduction and paying taxes down the road, when they may be in a higher tax bracket.

The Roth 401(k) was introduced in 2006 and provides a great opportunity for young investors to save with tax benefits in mind. Even more so, there is no additional cost to offering it. It’s a great feature to consider, especially as younger generations enter the workforce.

INVESTMENT LINEUP

Paralysis by analysis is the saying we use for investment lineups. Take a minute and put yourself in your employees’ shoes. You log in to your retirement plan website, navigate all the way to the investments and see 40+ investment options. Unless they are a day trader on the side, this plethora of choices can be very overwhelming and frustrating. But how do you narrow it down?

One simple way to ensure your company provides the right investment options is to create an Investment Policy Statement (IPS). An IPS helps ensure sponsors follow a prudent process for selecting investment options and evaluates their progression over time. A financial consultant can help you draft an IPS to get you started.

Once the IPS is created, it’s now time to make the investment options selections. It is our belief that your investment lineup should be easy to navigate, offering a hands-off option, and just enough index options to create a well-diversified portfolio. For us, this typically results in 10-15 index options plus a Target Date series with 5-year increments. This mix of investment options can provide employees with choices that best fit their individual need.

WITHDRAWALS

Even though these retirement plans are meant for retirement, employees can feel comforted knowing additional ways to access their hard-earned money. Outside of your traditional distributions (hardship, termination, death or disability) loans are the most common way an employee can access their savings.

However, I always advise to consider the future use of the provision. Again, these accounts are intended for retirement. Dipping into these savings can potentially impact their long-term goals. If you believe this will be abused by many of your participants then it may not be a good idea to allow for loans. But if you believe your participants will most likely only use in case of emergencies then it can be an appealing feature.

STUDENT DEBT REPAYMENT OPTIONS

As the workforce is being fueled by the younger generations, it is important to consider their needs. As a typical millennial, I entered the workforce with the heavy burden of student loan debt. Paying off these loans is part of every decision you make including saving for retirement. I was fortunate to be able to do both, but many aren’t.

To solve for this problem, the government recently filed an extension of a CARES Act provision that allowed employers to contribute up to $5,250 tax-free towards an employee’s student loans each year. With bi-partisan support, it is believed that this extension to 2025 will become permanent. In preparation for this, retirement plan recordkeepers are creating solutions to streamline the administration of that benefit.

There are a few very popular variations of this new benefit. One simply focuses solely on the employer helping to pay down student loan debt directly. The other solution includes a combination of helping them pay down their debt, while saving for retirement. That option looks like this: an employee wants to save for retirement but is burdened by large student loan debt payments. The company wants to incentivize the employee to pay down the debt by providing a match to their retirement plan when provided with a proof of loan payment. The participant wins because they are paying down debt and saving for retirement, and the employer wins because they are attracting young talent and while benefiting from a tax deduction for the match. We see this as a future evolution of retirement plans and because of that we highly suggest considering it as a benefit.

As you can see, there are many options out there to help you maximize your retirement plan. Be sure to consult with a retirement plan professional to help you decide the features that best fit the needs of you and your company.

Financial Advisor

JimTrujillo@argi.net

www.ARGI.net