By Jeanniey Walden

While the COVID-19 crisis has turned the world completely upside down for months, it also may have permanently altered the world of work. Employees and consumers have new concerns for security and safety that have grown out of the pandemic. For employees, increased financial stability is now at the forefront of their needs. After watching family members be furloughed or laid off as the prices of essential goods rose, a steady paycheck and benefits package became even more important to Americans than ever before. Because of this, pay flexibility went from a “nice-to-have” to a “need-to-have” benefit.

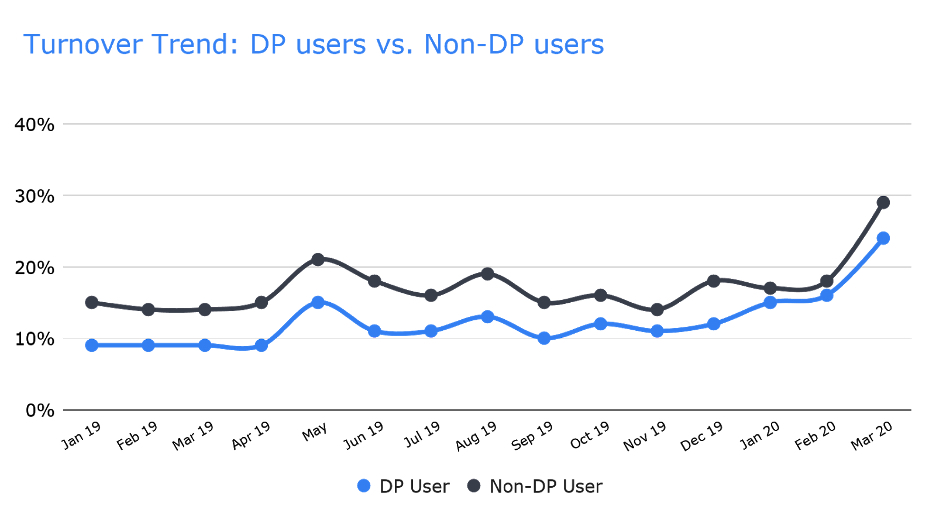

Before the pandemic began, our partners saw an average of 22% lower turnover rate among DailyPay (DP) users as compared to non-DailyPay (non-DP) users. At the start of the COVID-19 pandemic in March 2020, we noticed sharp increases in the turnover rates of both DailyPay and non-DailyPay employees, as some partners had to furlough or layoff their employees, while others experienced the impact of FMLA. This is evidenced in Figure 1 below, which shows the turnover trend among DP and non-DP users.

For many partners, especially large partners with high DailyPay adoption rates, the difference in turnover of DP vs. Non-DP users increased to an even wider margin. This is because employees with access to flexible pay tend to be more positive and motivated in their roles, since their hard work is rewarded with this life-changing benefit. Because of this, having access to daily pay makes them less likely to leave their jobs.

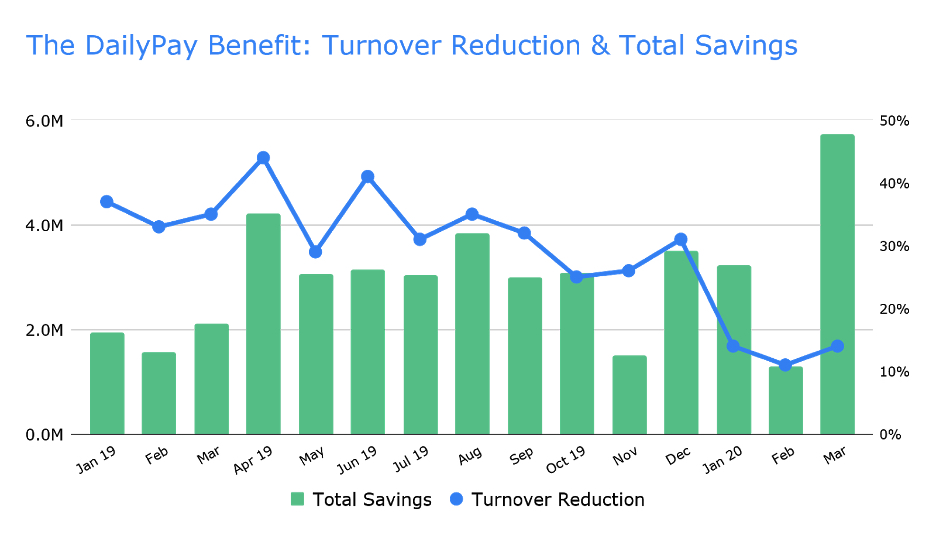

Our partners’ data also shows a dramatic improvement in cost savings as a result of turnover reduction. Among our partners, larger companies with higher DailyPay adoption rates see more prominent reductions in turnover. These large companies also see the highest cost-saving impact from offering DailyPay to their employees, which contributed to the $5.7M total cost savings that our partners benefited from in the month of March 2020, at the beginning of the coronavirus pandemic.

This spike is evidenced in Figure 2, the graph below:

DailyPay was a lifeline for both employees and employers during the COVID-19 crisis. Not only did it provide a safety net for employees who needed emergency supplies or the ability to buy essentials before their scheduled paydays, but it also helped employers reduce turnover costs during a time when many companies took sizable revenue hits. Providing a personalized pay experience may seem like a frivolous benefit to some, but quick data analysis shows that the financial and psychological rewards of this benefit are invaluable. Whether facing a global pandemic or simply living everyday life, on-demand pay access truly has the power to change lives, starting with better financial stability for all involved.

Jeanniey Walden

Chief Innovation and Marketing Officer

DailyPay

[email protected]

www.dailypay.com