by Denise Cabrera

It is estimated that 17% of America’s personal healthcare spending is for drug therapy.1 With the rise of personalized medicine and gene editing therapy drug spend is projected to reach $600B in 2020. Significant advancements will bring curative therapies to many individuals suffering from rare hereditary diseases. Several trends will further address the need to change the way we deliver and pay for healthcare in the U.S.

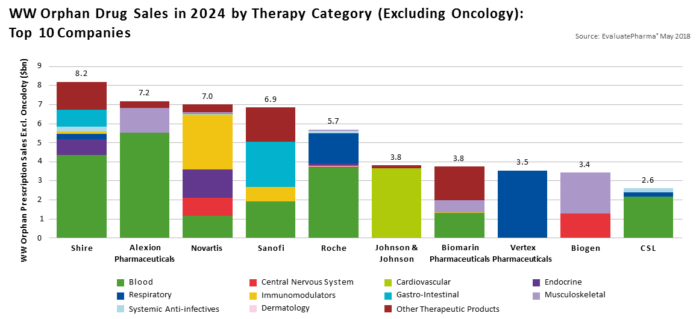

Specialty Biosimilar Pipeline $62 Billion Biosimilar Market 2020 – 2024

Specialty drugs are chemically more complex and are referred to as biologics because they are derived from living organisms or their products, such as a human or animal protein, hormone or antitoxin.

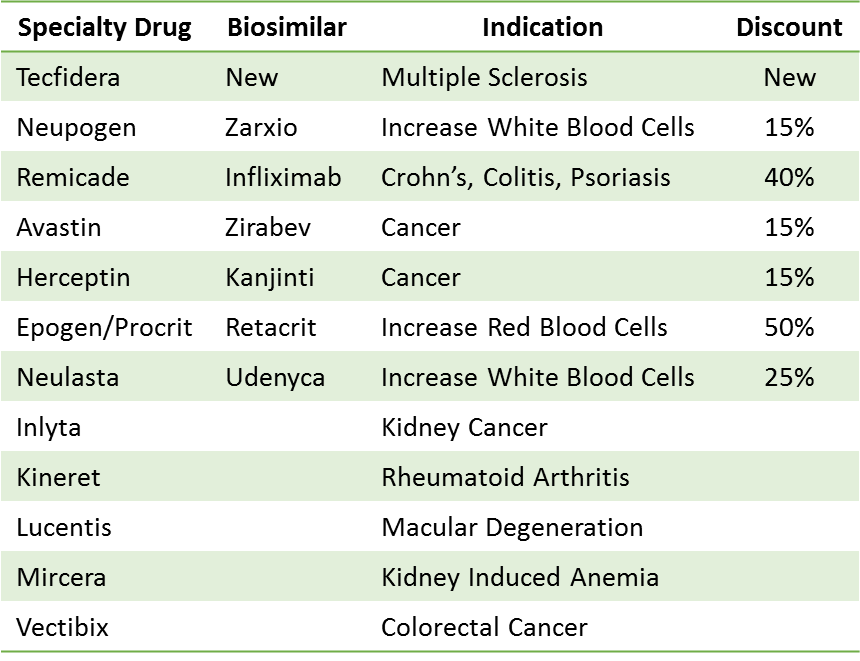

There is a $62B market for biosimilars over the next four years as competition in the specialty drug market increases. The first biosimilar was launched in the U.S. in 2015. Nine specialty drugs have lost their patent however only six of them have actually launched a biosimilar due to patent protection, patent litigation and manufacturing challenges.

A biosimilar for Tecfidera, used to treat multiple sclerosis, should launch 3Q2020 with the potential to impact annual sales of $3.5M. The biosimilar for Truvada is expected to launch in 2021. It is a pre-exposure prophylaxis for HIV and will have the potential to impact nearly $3B in annual sales.

Gene Therapy

New pharmacogenomic tests and gene therapies are entering the market at an astounding rate and are expected to grow by 10.5% over the next five years. These therapies bring life changing treatment options and hope to many people who are dealing with rare genetic diseases. Progress has been exceptional but these high investment therapies have also introduced new challenges for employers and the payer community.4

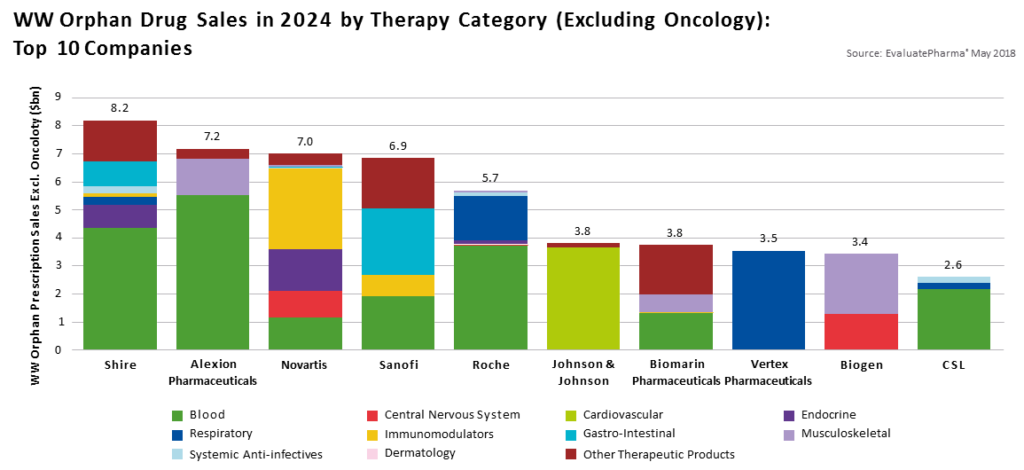

The 1983 Orphan Drug Act was enacted to incentivize research for rare diseases which are estimated to afflict 10% of Americans. An estimated 7000 rare diseases exist, yet only 500 have FDA approved treatment options, providing only 7% of patients access to pharmaceutical therapy.

Precision medicine targets specific genes, based on the patient’s condition. Genetic information is gathered through genome sequencing where researchers are able to identify specific abnormalities and come up with drugs and therapies targeted towards them. Gene therapy is designed to correct inherited genetic defects therefore it is curative and preventative for future generations.

The FDA has approved 4 gene therapies to date, including Zolgensma (Novartis), approved to treat a rare spinal defect. It is the highest cost gene therapy, currently at $2M per patient, and total sales of $361M in 2019. More than 900 investigational new drug applications have been submitted to the FDA in 2020. They anticipate approval of 10 – 20 gene therapies annually, driving more than $8.6 Billion in healthcare expenditure by 2025.

Unique Reimbursement Models for High Investment Therapy

High investment therapies have stretched current reimbursement models beyond their capacity. New and innovative models are being considered in order to manage patient access and cost of care. Value based arrangements and risk sharing across plan sponsors, PBMs, Payers and manufacturers is being considered in order to sustain affordability, ensure access to care and continue to incentivize manufacturer research and development efforts.

Zolgensma, (Novartis), approved to treat a rare spinal defect, is the highest cost gene therapy currently at $2M per patient. Sales of Zolgensma totaled $361M in 2019. Novartis expects to treat 100 infants each quarter.

These high investment therapies have stretched current reimbursement models beyond their capacity. Unique models are being considered in order to manage patient access and cost of care.

- Annuity Payments

- Novartis has agreed to annuity payments for Zolgensma over five years. Spark agreed to the same terms for Luxterna to treat a retinal disease causing blindness.

- Volume Based Purchasing – the Netflix Model

- State of Louisiana’s contract with Asegua/Gilead allows unrestricted access of the drug Epclusa, to treat and cure Hepatitis-C, for their entire Medicaid and prison population. Paying a fixed fee for use of the drug, over the next five years, will allow them to treat over 30,000 individuals by 2024. They estimate a savings of over $470M over the next five years in addition to a reduction of medical costs to treat progression of the disease.

- Direct Payer to Manufacturer

- Puts the onus on the Payer to prove failure of efficacy. It would not address short term budget issues but would prevent hospitals from marking drug costs up significantly and avoid issues with DRG payments.

- Reinsurance/Stop Loss

- Cigna’s Embarc Benefit Protection: Luxterna (Retinal Disorder) and Zolgensma (Spinal Muscular Atrophy)

- Anthem’s Gene Therapy Solutions: Roctavian (Hemophilia-A)

- Value Based Reimbursement

- Spark Therapeutics has agreed to VBR for its gene therapy, Luxturna, which cures a retinal disease causing blindness. The cost of $850,000 will be partially reimbursed if a patient fails to respond to treatment.

As we enter a new decade, the healthcare industry will continue to address challenges like reimbursement for high investment therapies and the impact of social determinants of health. Collaboration between payers, providers and manufacturers is possible, and most likely the best strategy to ensure cost effective access to quality care. When we look back ten years from now, my hope is that we can say “remember when we treated cancer with toxic chemo therapy and genetic disorders went relatively untreated?” That will certainly make the hard work we have to do well worth it.

Denise Cabrera

Licensed Clinical Pharmacist

National Pharmacy Practice Leader

McGriff Employee Benefit Solutions

813-682-1515

[email protected]

References

- https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NHE-Fact-Sheet

- Stanton D. In the pipeline: Surge of cell and gene therapies likely in 2020. BioProcess International. 2019. https://bioprocessintl.com/bioprocess-insider/therapeutic-class/in-the-pipeline-surge-of-cell-and-gene-therapies-likely-in-2020/

- Specialty Drug Spend Soars. Can Formulary Management Bring It Down to Earth?, Managed Care, 2019

- FAQs About Rare Diseases, Genetic and Rare Diseases Information Center, U.S. Department of Health and Human Services, 2017

- Trends in FDA approval of Specialty Drugs 1990 through 2017, RJ Health, 2018 https://www.cigna.com/newsroom/news-releases/2019/pdf/cigna-health-services-business-pioneers-an-innovative-solution-to-affordably-bring-life-changing-therapies-to-patients.pdf

- http://image.messageinsite.com/lib/fe5615707d600c747210/m/2/757027d4-dff0-4c1b-a50a-ce78326b9917.pdf

- https://www.cigna.com/newsroom/news-releases/2019/pdf/cigna-health-services-business-pioneers-an-innovative-solution-to-affordably-bring-life-changing-therapies-to-patients.pdf

- http://image.messageinsite.com/lib/fe5615707d600c747210/m/2/757027d4-dff0-4c1b-a50a-ce78326b9917.pdf