By Richard Works

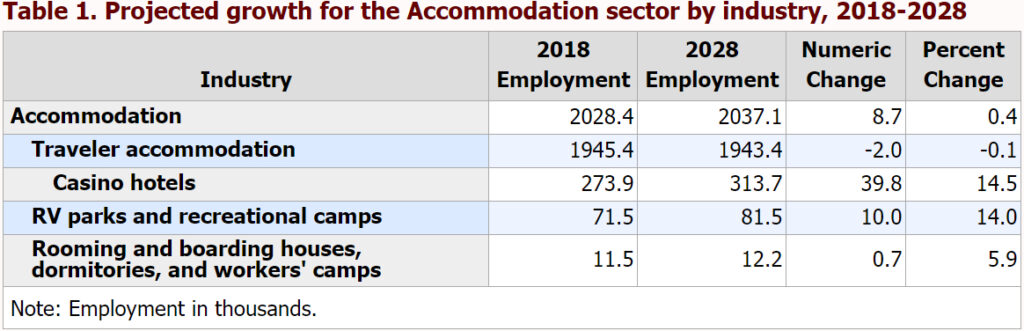

According to the US Bureau of Labor Statistics employment projections for 2018-2028, the Accommodation sector is projected to increase employment by 0.4 percent. In an industry sector of over 2 million total jobs, the projected addition of just shy of 9,000 new jobs by 2028 doesn’t sound like much may be going on. These top line numbers, however, mask differing trends and growth rates within the sector’s component industries.

While the overall sector is projected to experience little growth, the Casino hotel industry is projected to grow much faster – 14.5 percent – and is adding nearly 40,000 jobs by 2028. Employment in the Recreational parks and camps is also projected to grow 14 percent and add about 10,000 jobs. There are three main factors expected to impact projected employment trends in the Accommodation sector: (1) Emergence of alternative short-term rentals; (2) Experience redesigns for casino hotels; and (3) Changing consumer preference toward vacationing outdoors.

Short-term rentals

The traveler accommodation industry is projected to have a small employment decrease over the next decade due primarily to competition from alternative short-term rentals. Travelers are increasingly using alternative accommodations for their travel plans. The growth of services like Airbnb increases competition for hotels. In 2018, consumers spent more money on Airbnb than they did at Hilton, DoubleTree, or Embassy Suites, and the amount is nearing that of Marriott. Between 2013 and 2018, Airbnb sales increased 1,060 percent, compared to 85 percent for Marriott and 51 percent at Hilton hotels. Another big player in the short-term lodging rental market, HomeAway, increased sales by 611 percent over this same time period. What makes these figures more remarkable is that revenues for the alternative short-term lodging market include only the fees for bookings and not the additional costs for food, beverage, and incidentals, such as is the case with traditional hotel revenues.

A 2018 academic study confirmed that the entry of Airbnb negatively affects hotel revenues in cities where hotels are more likely to be capacity-constrained, and that the effect is more concentrated on price than on quantity, at least compared to non-capacity-constrained cities. The availability of short -term alternative lodging such as Airbnb acts as a price increase release valve in these markets, forcing the hotels to limit lodging rate increases that would otherwise occur when demand increases and there is fairly fixed supply.

Tourism Economics and Smith Travel Research projected a slowdown in performance growth for 2019 and 2020. They suggested that demand is softening. The industry was projected to report flat occupancy in 2019 and a 0.2 percent decrease in occupancy for 2020. Three months after their forecast, booking rates declined across North America. The Wall Street Journal reported slowing hotel growth could be worst in 10 years. The cooling off is a result of lower demand due to the amount of new hotel supply and other options, such as Airbnb, available to consumers.

New offerings at casino hotels

Casino resort hotels are projected to increase employment over the next decade. These resorts operate as self-contained facilities to increase their profitability. They may incur losses from their entertainment, food, and beverage offerings, but the inducement for visitors to use the gaming floor ensures sufficient revenues. According to professor and gaming historian, Dr. David Schwarts, a large resort hotel with numerous amenities tied to a gambling casino made perfect sense in a tourist destination hundreds of miles from the nearest major city. He suggests that casino resorts have reinvented themselves as non-gaming leisure and business travel destinations that just happened to have casinos attached.

Casino operators provide amenities beyond gaming and market their properties as entertainment destinations to attract new customers. Instead of only targeting gamblers and vacationers, establishments are also targeting business travelers and groups. Patrons may visit a casino for dining, shopping, concerts, or other activities and events, such as corporate parties and meetings. Attracting these new customers provides opportunities to boost gaming revenue as the customers are introduced to the gaming floor just by being there. However, non-gaming revenue will have to increase since remote and digital gambling will become widespread; MGM Resorts chief sales officer, Michael Dominguez, confirms that nongaming revenue is a large part of their business today.

Between 2009 and 2018, employment in the gambling industries (except casino hotels) was down around 10 percent, but up around 9 percent for the casino hotel industry. Gambling Industries (except casinos hotels) are projected to decline 16.3 percent in employment over the 2018-28 decade. According to market research, long-standing non-hotel casino operators have struggled due to the influx of casino hotels in states that removed a ban on casinos. As states seek to boost struggling funds, the non-hotel casino industry will be faced with increasing pressure from the casino hotel industry. A plausible explanation behind this decline is that added entertainment options at casino hotels are becoming more attractive to non-gamblers.

More vacationing outdoors

Employment in RV parks and recreational camps is projected to grow 14 percent to 2028 and add about 10,000 new jobs due to vacationing becoming more of an outdoor activity. The key drivers for this projected increase includes younger and more diverse campers, millennials having kids and taking them camping, and an increased love for the outdoors. The percentage of campers who camp three or more times each year has increased 72 percent since 2014 according to the 2019 North American Camping Report sponsored by Kampgrounds of America. Since 2014, more than 7 million new households began camping; more than one million started in 2018 alone with 56 percent being millennials and 51 percent being non-white groups. More than half of the growth (72 percent) came from those that camp three or more times per year. The 2019 report suggest that momentum would continue, and survey results show enthusiasm for taking more trips each year.

According to a Forbes article, the increase in new campers (both younger and more ethnically diverse) seems to be due to a number of factors, including general accessibility to camping and various forms of unique camping accommodations, along with increased access to Wi-Fi and cell service. Millennials and Generation X campers have a high tendency to share on social media their videos and photos from their experience, which boosts others’ desire to replicate these moments.

Dr. Richard Works

Adjunct Assistant Professor

University of Maryland Global Campus

richard.works@faculty.umgc.edu