Employee benefits have continuously evolved since the 1900s, long before COVID-19. However, the pandemic has changed work for the foreseeable future and any trends we may have witnessed in employee benefits will likely follow suit. Pending a COVID-induced recession (if we’re not already in one), there is a possibility that employers will suspend or limit their offerings.

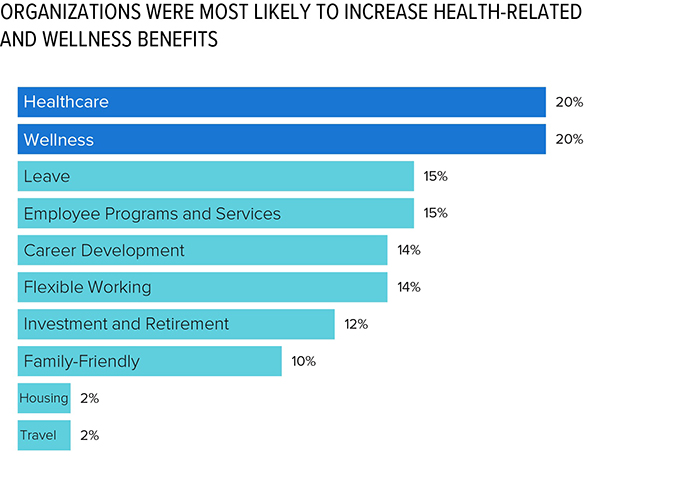

We’ve seen this before. During the Great Recession, although employee benefits remained relatively stable, offerings experienced a downward trend. Many organizations shifted the cost of benefits on employees in order to assuage the rising expenses of employee benefits. And in the years since, several factors have shaped the benefits landscape. In the 2019 SHRM Employee Benefits report, healthcare and retirement were the leading benefits in importance to the American workforce. In addition, one-fifth of organizations reported that they had increased healthcare benefits since 2018. Wellness benefits were also experiencing a steady rise: 20 percent of organizations increased these offerings in 2019 despite employers ranking wellness near the bottom in importance to their workforce.

While there is still so much uncertainty around future workplace trends right now, one thing remains: Employee benefits will always play a crucial role in attracting and retaining talent, improving overall health and wellbeing, and so much more. As organizations prepare their 2021 benefits packages, it’s important to note that this is one of the least predictable economic periods of the last several decades. It is entirely possible that information available now may not be as relevant a few months or even weeks down the road.

What might we see from future employee benefits?

Telehealth Services

One of the most notable changes we will likely witness in 2021 is the rise of telehealth services—a trend already set in motion but aggressively propelled by the COVID-19 pandemic. Most large employers already offer telehealth services, but employee utilization rates have typically been low. Over the past few months, however, many employees have had no choice but to resort to telehealth services in order to access care during the pandemic. Not only is this convenient for employers and employees alike, it can mitigate increasing health insurance plan costs, as telehealth services are often cheaper than comparable in-person treatments. As a result, there is a clear incentive for organizations (especially small businesses and those whose health plans are self-funded) to provide, expand, and communicate telehealth services to employees.

Telehealth services are also important for assisting organizations in expanding healthcare access to underserved urban and rural communities. Often these communities have limited availability of physicians and must travel to receive care. Sometimes they go without treatment completely due to the lack of in-person services and knowledge about available telehealth services. Organizations will have a larger role to play in bridging the healthcare disparity gap and should continue to provide telehealth services and communicate the advantages of these services to employees.

Flexible Work Benefits

Although remote work was a growing trend before COVID-19, it would have taken much longer for organizations to tackle such a disruptive change unprompted. Like telehealth services, the pandemic has catalyzed the remote work shift that has been in the making for years. Now organizations will need to decide if they want to make remote work a core part of their benefits portfolio. A SHRM study on remote work during COVID-19 found that more than 70 percent of American workers would prefer working remotely either full-time or part-time if they had the choice. What’s more, 68 percent of organizations report they probably or definitely will adopt broader or more flexible work from home policies for all workers. This will be largely impactful in knowledge-work organizations headquartered in expensive metro areas—especially if a recession becomes a reality, the lure of relocating to areas with lower cost-of-living will be strong for employees who don’t need to be physically present in an office.

As the economy begins to reopen, it is also plausible that employers will continue to offer flexible work benefits that may have been expanded or added due to COVID-19—at least on a case-by-case basis. Some of these benefits include flexible scheduling, compressed workweeks, and part-time work—all of which are necessary for vulnerable employees and those with childcare or eldercare responsibilities. Many employees in the return-to-work phases are grappling with unpredictable school schedules, their personal health, and potentially exposing their clients or family to COVID-19. SHRM Research found that of organizations currently providing childcare accommodation to employees during the pandemic, 1 in 10 plan to keep these policies indefinitely. Organizations might also begin offering additional assistance such as referral services, subsidized care, or on-site care facilities to those with caregiving responsibilities who are called back to their worksite. Even employees without dependents may need extra flexibility, as public transit remains disrupted in most metropolitan areas.

Wellness Offerings

During the COVID-19 pandemic, one-third of employers saw an increase in requests for information about Employee Assistance Programs (EAPs). With the continued necessity for remote healthcare options, an ongoing strain placed on employees by the pandemic, looming recession, and other stressors, the importance and usage of EAPs will see an upward trajectory. SHRM Research has found that as many as 1 in 5 employees still struggle often with symptoms related to depression in the course of the pandemic. Further, more than 40 percent of employees feel burnt out, drained, or exhausted from work during this time. Like telehealth options, many employees who never used EAPs may have recently tried them and found them useful. While virtually all EAPs provide some type of clinical counseling, other EAP benefits that workers may need to access in the pandemic era and post-pandemic era include child or eldercare referrals, legal and financial counseling, and even pet care resources.

Organizations are prioritizing wellness more than ever before, but it is still possible that certain benefits such as gym/fitness memberships and on-site engagement activities may be at risk in organizations that are impacted financially by the pandemic and recession. This is especially true for small to medium-sized organizations. Many employers are still uncertain when they will call their employees back to the worksite (if at all). Even after a partial or complete phase-in, wellness benefits such as these may still be unavailable for the foreseeable future. Employers may choose to save by cutting these programs, or continue to offer them remotely or in-person but with limited capacity. While they may be some of the first to go, organizations shouldn’t forget that the wellness programs they ultimately keep could very well save on healthcare costs in the long run.

Investment and Retirement

There is a chance that we may witness across-the-board tightening of certain benefits into 2021 as organizations decide how to navigate current and post-pandemic economic uncertainty. Several organizations have already announced that they are reducing or deferring 401(k) matching funds. Conserving cash in this way is relatively normal during hard times—we witnessed this in the Great Recession, where more than 200 major companies suspended their matching contributions to ease cash flow constraints. Many of these cuts were temporary and reinstated post-recession, however.

There are still many employers who are easing access to 401(k) assets rather than suspending their contributions. In addition, there are also new retirement planning options that were recently passed in the SECURE Act. Some key takeaways from the Act include allowing long-term part-time employees to participate in their employer’s retirement plan, offering small business tax incentives to set up automatic enrollment for workers, allowing open multiple employer plans, among others. Innovative organizations looking to switch up their retirement offerings to better fit new staffing plans may soon take advantage of these options if they haven’t already.

Lastly, there is a new provision under the CARES Act that authorizes employers to make tax-free contributions of up to $5,250 directly to employees’ student loan accounts—the same limit as employer payments for current education. Previously, the provision only allowed for an exclusion from an employee’s income for educational assistance provided by an employer. While the newly instated tax exemption is valid only through the end of 2020, there is a chance it could be adopted as a permanent change to the tax code. For employees with outstanding student loan debt, this benefit could be incredibly important if a recession comes to pass and those with high-interest student loans are unable to refinance. Employers should weigh these new incentives before deciding if any changes need to be made to their existing educational-assistance programs.

Organizations will have to keep an eye on the shifting sands of benefits compliance, as continuing legislation related to the public health crisis and those designed to stave off a recession will continue to impact employers well through 2021.

Although there is still so much uncertainty around future employee benefits, the pandemic has set in motion a slew of potential new offerings and has even expedited some trends. Until open enrollment in November, organizations should consider how their employee benefits can help them stand out now and in the post-COVID phase.

Casey Sword

Research Specialist

Society for Human Resource Management

[email protected]

shrm.org