By Richard Works

As election campaigns begin to gain prominence in the media, one may often contemplate the effect they may have on the economy. Gary Stringer, Kim Escue, and Chad Keller of Stringer Asset Management published a wonderful article in ETF Strategist Channel on this topic. Their article suggest that elections do not have major economic impacts based on their analysis of GDP, population growth, labor force growth, and labor productivity. This caused me to wonder about the unemployment rate and jobs that were added/subtracted from the economy, in addition to what economic research may suggest.

This article will review economic literature on market influences from my doctoral dissertation, and extend the work of Stringer, Escue, and Keller by examining the unemployment rate and total nonfarm payroll employment. Please note that the contents of this article is based on the opinions of the author and may not reflect the opinions of the Bureau of Labor Statistics.

Review of Economic Literature

This section highlights research from my doctoral dissertation. To obtain the original sources, please consult the dissertation available freely on ProQuest.

Elections, terrorist activities, wars, and political scandals have considerable influence on financial markets. Exchange rates react faster to geopolitical events than any other form of financial investment. Research shows that election outcomes have the potential to threaten asset prices and the economy as a whole. A political resignation could potentially cause abnormal returns in the field and affect currency markets. A geopolitical event will have a negative impact on the economy when the event undermines the confidence of investors

During political instability, investors seek safety by divesting their investments, which depreciates the domestic exchange rate. The democratic processes contribute to the risk premiums that affect interest rates as political events raise doubts and concern about the government. Presidential candidates often float policies that could strengthen or weaken the economy (depending on your view), therefore causing investors to anticipate uncertainties in which premium will be required for a forward position, thus affecting spot and forward markets.

The risk of war also has strong impacts on fluctuations of financial variables. In economic literature, violence has shown to affect asset market reactions and it was found that conflict has significant impacts on prices of currency, oil, stock, commodities, and gold. This shows that markets are sensitive to news about future prospects. The Iraq war increased oil prices while decreasing the value of the US dollar, Treasury yields, and equity prices. Terrorist activities also have a negative on financial markets as foreign investors divest their investments.

Trade restrictions make the domestic economy better off by modifying the terms of trade in favor to improve current account balance that appreciate the domestic currency. However, the volume of exports has a positive effect in the GDP. Therefore, regulations limiting exports would negatively affect growth of the economy.

Natural disasters and global virus outbreaks provide significant effects on financial markets and economies. Significant adverse impacts from disasters and global virus outbreaks slow down production, which disrupts import and export activities, which will yield a decrease in an economy if the economy is dependent upon exports. Less demand for a domestic currency will occur if the domestic economy is unable to meet foreign demand because of a natural disaster or similar major event.

Unemployment Rate and Jobs Added

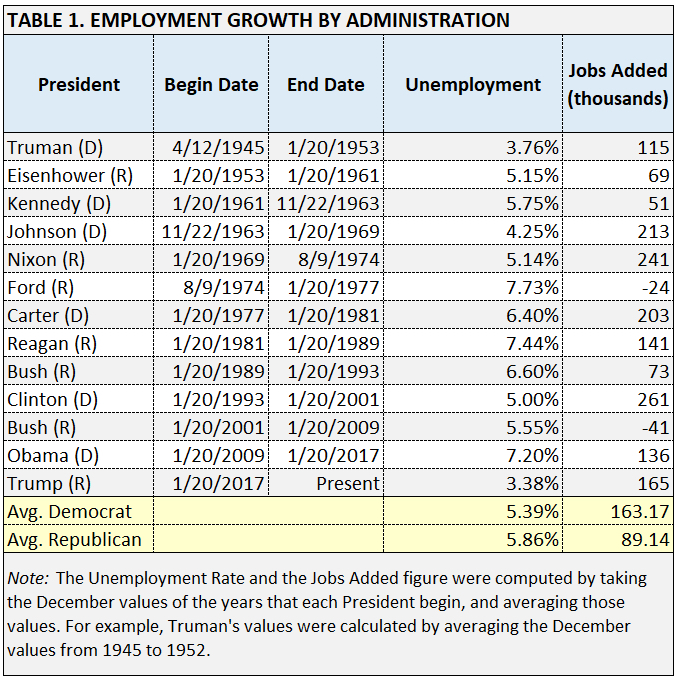

Now that we have clearly seen that economic research supports the notion that elections can affect the economy, we will look into two measure of the economy to examine real world examples. Through this analysis, we will see if our findings corroborates economic literature, or if our findings differ, thus adding additional information to the boding of knowledge on this subject. The variables that we will examine are the unemployment rate and the total nonfarm payroll employment (jobs added). See table 1.

According to historical data, it would not matter whether a US President is a Democrat or Republican when it comes to the unemployment rate. The unemployment rate averaged similarly for both parties. On the other hand, history has suggested that Democrat presidents tend of have created more jobs when compared to Republican presidents. However, when looking deeper than the political party, it appears that more is at hand. This suggest that the political party of the President, and thus the presidential election, does not have a major effect on the unemployment rate nor the number of jobs added. This is because, regardless of political views, each President should be working for the good of the country. It would be ridiculous to consider that a President would have the goal of getting people out of work because that would have major effects on the economy and put a major strain on the government since the government is funded by taxes.

So what was going on?

World War 2 was ending as Truman was coming on the scene, but the Korean War came about toward the end of his presidency. After the Korean War ended, the unemployment rate begin in decrease, but in the latter part of Eisenhower’s presidency, a recession followed an increase of the minimum wage. During Kennedy’s presidency, the Cuban Missile Crisis happened, and then the US entered the Vietnam War under President Johnson. During the war, a recession took place under Nixon. Then the war ended, and Ford became President, which is when the recession started to end and an expansion occurred.

As the expansion continued, President Carter took charge and raised the Fed rate to 20% to stop inflation, which was followed by a recession. When Reagan was elected, he initiated tax cuts, an increased minimum wage, and a job training partnership act. This resulted in an expansion; however, a recession was underway when President Bush entered the Desert Storm War. When Clinton was elected, there was welfare reform and the School to Work Act, which was followed by expansion. However, then the Serbian airstrike occurred. When the second Bush president was elected, he also initiated tax cuts, but this effort to grow the economy was undermined by the 9/11 terrorists attacks.

President George W. Bush had a rough time with the War on Terror and Hurricane Katrina, then came the financial crisis of 2008. When Obama was elected, he also initiated tax cuts, but the financial crisis caused 26 months of job losses. The Iraq War finally ended and the economy slowly started to grow, then President Trump was elected, and the unemployment rate hit record lows and the stock market hit record highs.

The verdict

It has been clearly documented in economic research that political events can affect financial markets. But the analysis of this paper suggest that political elections do not have a significant effect on the unemployment rate or jobs added. We also saw that the political event that has the biggest negative effect to the economy is war. We also saw that natural disasters can also affect the economy. So for the upcoming election, I would not expect the political outcome to influence future employment. However, future wars or unexpected disasters will have a bad impact. Thus, I concur with Stringer, Escue, and Keller based on unemployment and jobs added.