By Daniel Berry

Every year, a pension plan sponsor has a range of possible amounts that can be contributed to their plan. The IRS has rules specifying the minimum required amount that must be contributed each year, as well as the maximum deductible amount allowed. As long as the plan sponsor makes a contribution falling within that range each year, the IRS is satisfied. But, is funding the amount that is always at the bottom of that range a prudent funding policy? Or is there something better?

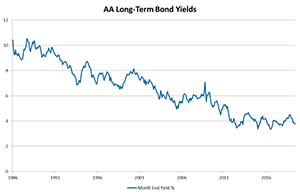

When a plan sponsor makes only the minimum required contribution (MRC) every year, they are in essence hoping that interest rates rise (in the last 30 years, it hasn’t happened – see chart below) and/or assets do well (as they have for approximately the last 10 years). However, hope is not a strategy. Many plans that have only contributed the minimum in recent years are no better funded today than they were years ago. In fact, most are worse off. This is due in large part to the declining interest rate environment over the last 25 years, as lower interest rates mean higher liabilities and thus a lower funded status.

Interest rates for

funding purposes are based on a 2-year average of long-term bond rates. However, legislation passed earlier this

decade allows these rates to be based on the 25-year average of long-term bond rates

(“rate relief”) and given the current low interest rate environment, higher

rates at the beginning of the period are being replaced with today’s lower

rates in the average, so funding rates in the near future will be even lower

than they are now. Additionally, this

rate relief is scheduled to “wear off” by 2024, leading to further downward

pressure on funding rates. This means

that funding liabilities will be higher and funded statuses of plans will be

lower. The result is the MRC will be

rising in the near term.

So rather than having a relatively stable contribution over a period of years

(as might result when consistently contributing more than the MRC), the plan sponsor

will be looking at increasingly larger contributions each year, possibly when

they are less affordable.

Thus, funding only the MRC is really just “kicking the can down the road” and provides no cushion for declining rates and possible future asset declines. In contrast, contributing an amount greater than the MRC might allow for the creation of a prefunding balance (sort of a “rainy day” fund) which could potentially be used in the future to offset some contribution requirements.

Additionally, at least until the rate relief previously mentioned wears off in a few years, plan sponsors will be faced with rising Pension Benefit Guaranty Corporation (PBGC) variable rate premiums. This is because the liability for PBGC premium purposes is currently larger than the funding liability used for the MRC. In addition, the variable rate premium percentage is indexed to increases in national average wages, meaning that even if the funded status were to be maintained year-to-year, the premium would increase. Therefore, unless assets perform very well, funding only the MRC will likely lead to higher PBGC premiums.

If the plan is large enough, a lower funded status could also lead to the plan sponsor having to complete a 4010 filing with the PBGC. Under Section 4010 of the Employee Retirement Income Security Act (ERISA), certain underfunded plans must report extensive information to the PBGC. This is not a simple undertaking, as gathering the information needed for submission can be quite onerous. This applies not only to the plan sponsor, but also to each member of the plan sponsors’ controlled group. The entire controlled group must supply the required information.

In addition, if the funded status of the plan were to decline in the future, the plan may be more likely to be faced with an Adjusted Target Funding Attainment Percentage (AFTAP) falling below certain thresholds. This could lead to various benefit restrictions, including cessation of benefit accruals (if the AFTAP is less than 60%) and not being able to pay the full lump sum or Social Security level income option to a participant making such an election (if the AFTAP is less than 80%). This could be a very bad employee relations issue.

Many pension plans are now either closed to new entrants or have frozen future benefit accruals. When the decision to close or freeze a plan was made, the usual goal would have been to eventually terminate the plan. However, the MRC is designed to achieve a funded status of 100% (and nothing higher) over a period of seven years, using the mandated funding rates. The problem is that in order to terminate a pension plan, a higher funded status is required because the liability for a terminating plan is higher than the liability for an ongoing plan due to the differential between interest rates used for those two purposes. Following a contribution policy of only making the MRC means that reaching the goal of a funded status sufficient to terminate the plan by a specified date is left to chance.

In summary, contributing only the IRS minimum ultimately leaves a pension plan sponsor with less control over the plan cost and the related funding volatility, with the added potential of the undesirable outcomes discussed above. The sponsor will likely be faced with higher ultimate costs and will simply be reacting to the forces of the market, as opposed to making a plan and managing those costs and volatility proactively.

Daniel Berry

Senior Vice President and Consulting Actuary

McGriff Insurance Services

[email protected]

336-291-1143