Spending on employee health benefits is an increasing part of overall expenses, crowding out investment in growth and making the issue an escalating concern for the C-suite. Recently, this routine challenge intensified due to the declining practice of cost shifting through higher employee deductibles, copays and coinsurance rates. What was once a core tactic for cost containment has generally passed the point of diminishing returns.

To help solve this latest configuration of the healthcare riddle, employers first need to determine the unique underlying factors driving their healthcare spending, and then implement strategies that directly address them. The starting point is conducting an analysis of organizational data to understand the employee population’s state of health — including the results of health risk assessments as well as healthcare claims utilization and spending patterns.

Most employers will uncover four common drivers of health benefit costs. A high prevalence of chronic health conditions such as obesity and diabetes, as well as hypertension and other cardiovascular diseases — often linked to poor health habits — is probably familiar. The prospect of encountering highly variable quality and costs of provider-delivered healthcare is also strong. And escaping the problem of epidemic opioid misuse that affects all U.S. population segments would be unusual. Fortunately, applying effective cost-containment strategies in all of these areas increases the likelihood that overall progress will be greater than the sum of its parts.

Promoting population health management programs

Across every employee population there’s a distribution of health status from top to bottom. Some people are fit, and others are either at risk for developing chronic conditions or already coping with disease as high-cost claimants. Non-claimants moving down on this scale are ticking time bombs from a healthcare cost standpoint. With the support of health management programs, employees in need can work to prevent chronic health issues from developing or getting out of control.

It’s imperative to help at-risk employees stay healthy through programs that identify and engage them in wellbeing programs and the healthcare system. Employees already living with a full-blown health condition also need the proper care to effectively control its effects — helping them avoid the emergency room and inpatient care. In some cases, interventions can even reverse disease progression.

| FOUR STRATEGIES TO ADDRESS COST DRIVERS OF KEY HEALTH BENEFITS | |

| 1 Population health management programs | |

| 2 High-performance narrow networks | |

| 3 Opioid dependency prevention and treatment | |

| 4 Proactive management of specialty pharmacy |

Encouraging the use of high-performance narrow networks

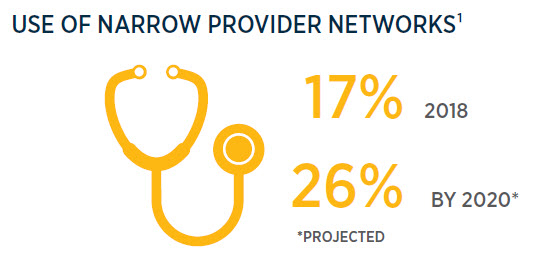

More employers are recognizing the importance of directing employees to higher quality, lower cost providers and facilities. In 2018, 17% used narrow networks, and that percentage is expected to reach 26% by 2020. Greater transparency of data on quality and cost has made it easier to compare provider care across the country, in local markets and even within a single provider organization. The variation can be shocking. Pricing gaps for some procedures may be as broad as 3-5 times or more, from lowest to highest, depending on the provider and the site of care.

Patient health outcomes may also differ significantly, impacting the total cost of care that includes treating complications from a procedure. And unlike most other industries, higher prices in healthcare are not necessarily correlated with higher quality.

The primary strategies for helping ensure that employees choose preferred providers are to mandate the use of high-performance narrow networks, or incentivize this option through tiered-network plan designs. Providers include centers of excellence for specific procedures or conditions.

When contracting with narrow networks directly or through health plan administrators, employers can negotiate discounted pricing in return for greater patient volume. Contracts may also include payment models that incentivize the providers to deliver better care at a lower cost. Another option is to use healthcare navigators that recommend preferred providers and facilities to employees — an approach that’s available with or without a narrow network benefits plan.

Actively addressing opioid dependency prevention and treatment

One of the hard truths of the opioid epidemic is the fact that prescription medications provided through employer-sponsored health plans contributed in large part to the crisis. Tragically, roughly 1 in 4 patients prescribed these drugs for chronic pain misuse them — and around 1 in 10 will develop an opioid use disorder (OUD) requiring treatment for recovery and sobriety. Among the biggest inhibitors of effective employer action is the stigma of addiction. And many employers just don’t know where to start.

Strategies and action plans are now available to help employers confront and better manage the workforce challenges of OUD. A proactively developed, holistic approach to policies, programs and benefits focuses on accessible alternatives in three critical areas — managing chronic pain, removing barriers to evidence-based treatment and educating health plan members to self-advocate. Establishing a comprehensive drug-free workplace policy that includes testing for synthetic opioids supports these objectives. And success is reinforced by giving employees who test positive or self-identify a second chance — allowing them to return to work after treatment.

The engine for activating this solution is a well-rounded employee communication platform, which uses supportive messages to emphasize “this could happen to anyone” and “OUD is a disease and not a moral failure.” In addition, this platform can confidentially connect employees and their family members with recovery and treatment resources through an employee assistance program. Guidance for patients on talking with their physician about opioid alternatives, and training for supervisors on identifying and privately addressing at-risk employees also boosts the potential for positive outcomes. Throughout, transparency and compassion will reduce fear and anxiety about workplace retribution — encouraging employees to come forward and seek treatment.

End-to-end solutions like this help employers maintain a safe workplace. They’re instrumental in addressing substance abuse and reducing its heavy financial toll and other costs — by enabling affected employees to once again be productive contributors to the organization.

Proactively managing specialty pharmacy use

Increasingly, employers are more actively controlling the growth of spending on specialty drugs. Although these prescriptions are only a small subset of the entire pharmacopeia, they drive about 50% of costs and represent 1%–2% of claims.

Their redeeming quality is that many represent breakthrough life-changing or life-saving therapies — but the growing number of pricey specialty medications for treating an expanding quantity of conditions poses a challenge.

The uncertainty of price and treatment variables sometimes makes it difficult to predict prescription drug costs in a given year. Predictive modeling can more sharply define the cost challenge of specialty drugs, and help employers identify appropriate plan designs and policies. In many cases, those policies will include prior authorization and step therapy as measures for verifying the patient is receiving the right therapy for their needs.

Prevalent chronic health conditions, variable healthcare quality and costs, the persistent opioid epidemic, and proliferating specialty drugs form the four quadrants of healthcare cost opportunity. By focusing containment efforts in these areas, employers can build momentum toward more stable, sustainable investments that consistently meet the health needs of employee populations.

Seth Friedman

National Pharmacy Practice Leader

Seth drives the national pharmacy practice strategy and assists with consulting, auditing, benchmarking, implementations and Medicare Part D support. He focuses on helping clients achieve their pharmacy benefit management goals at significant savings.

Jill Goldstone

Area Vice President, Innovation, Mid Atlantic Region

Primarily focused on innovation, Jill brings leading-edge solutions to clients. She recently collaborated on a program to address opioids in the workplace, aimed at resolving stigma and building support and recovery strategies. Jill also assesses vendors to identify capabilities that match clients’ needs.

Mark Rosenberg

Area President, Healthcare Analytics

Mark guides his team in providing clients with accurate quantitative monitoring and an effectively managed health plan experience. He consults on topics such as cost-savings approaches and population health management.

¹Arthur J. Gallagher & Co., “2018 Benefits Strategy & Benchmarking Survey,” November 2018

²National Institute on Drug Abuse, “Opioid Overdose Crisis,” revised January 2019

³Gallagher National Pharmacy Practice database

Consulting and insurance brokerage services to be provided by Gallagher Benefit Services, Inc. and/or its affiliate Gallagher Benefit Services (Canada) Group Inc. Gallagher Benefit Services, Inc. is a licensed insurance agency that does business in California as “Gallagher Benefit Services of California Insurance Services” and in Massachusetts as “Gallagher Benefit Insurance Services.” Neither Arthur J. Gallagher & Co., nor its affiliates provide accounting, legal or tax advice.

This is just one of 19 articles from Gallagher’s 2019 Organizational Wellbeing & Talent Insights. To download the full report, visit ajg.com/owti-2019.

© 2019 Arthur J. Gallagher & Co. | 27335P