By Eddie Vaughn

Amid the widely-publicized decline of defined benefit pension plans, one type

of defined benefit plan, the “cash balance plan,” has actually been growing in popularity. These plans have the distinction of being the

most “time-tested” of all the hybrid plans, combining many of the desirable

features of traditional defined benefit plans and defined contribution plans.

What’s the attraction to the cash balance plan that has caused the growth? For smaller employers seeking to upgrade benefits, they can offer larger tax deductions and benefit security that is lacking with a stand-alone 401(k) plan. For other employers, it can be an important component of pension de-risking strategy, offering lower cost and volatility while avoiding the loss of benefit security following a freeze or termination of the traditional defined benefit program.

Cash Balance Defined

Cash balance plans create a notional account for each participant, defined by contribution credits and interest credits. The contribution credit can be a percentage of pay or a flat dollar amount. The interest credit is a stated rate; either a fixed rate such as 5%, or a variable rate tied to an index, such as the 30-year Treasury rate. Specifying the earnings rate in this manner means that the plan will pay benefits based on this guaranteed rate, regardless of the actual earnings (or losses) on the underlying assets. This is the fundamental distinction between these plans and a traditional defined contribution plan, where employees’ benefits rise or fall with the change in plan assets.

Cash Balance Features and Advantages

Traditional defined benefit plans and defined contribution plans each have unique strengths and weaknesses, often leaving employers who are designing or updating a retirement benefit strategy to wrestle with the tradeoffs. A cash balance plan, being a hybrid, might be the optimal choice for many employers in many situations. The advantages include the following:

Benefit security. Traditional defined benefit plans provide a more predictable retirement benefit than defined contribution plans. Several features of defined contribution plans account for their potential shortfalls, including employee participation being voluntary (usually), the ability to divert accounts to uses other than retirement, and, primarily, that benefits vary with the performance of the underlying plan assets. In contrast, cash balance plans afford the same predictability and are covered by the same Pension Benefit Guaranty Corporation (“PBGC”) insurance program as traditional defined benefit plans.

Cost stability. The other side of the coin to benefit security is potential volatility and higher costs. When assets underperform, or other plan experience adversely varies from expectations, employer costs can increase. Premiums for PBGC insurance have also increased dramatically in recent years. Indeed, it is high cost and volatility which have prompted many employers to migrate toward defined contribution plans over the years. Cash balance plans often avoid many of these problems. Because the benefit levels provided are usually lower, the associated costs, including PBGC premiums, are likewise lower and more manageable. In that respect, they provide a good balance between benefit security and cost, which is not available to as great a degree in traditional plans.

Employee understanding. Many would argue that having benefits stated as an account balance, as they are in traditional defined contribution plans, does not provide a sufficiently transparent indicator of benefit adequacy. Nonetheless, traditional defined contribution plans are usually cited as enhancing employee appreciation and understanding of the plan, due to the member’s familiarity with a vehicle that is relatable to a bank account. On the other hand, the concepts in a defined benefit plan are generally more complex and can present a challenge. In cash balance plans, the account-format structure should be easier to understand.

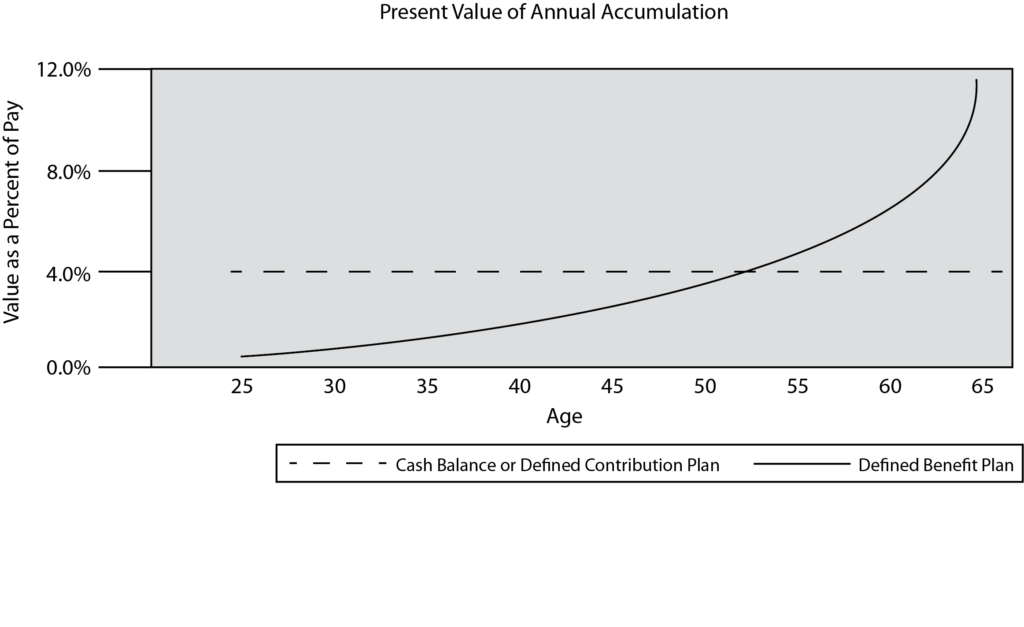

Targeting benefits demographically. In general, the accrual patterns in a traditional defined benefit arrangement deliver more benefits to older, longer-service workers, while the opposite is usually true in defined contribution plans. This is illustrated graphically below using examples of a 4%-of-pay defined contribution plan (or a cash balance plan), and a traditional defined benefit plan with a typical annuity formula. Employers’ preferences can vary: some may prefer a vehicle that delivers more benefits to earlier years to accommodate a mobile workforce (provided high turnover or generous vesting doesn’t drive up cost), while other employers, even today, prefer steering benefit dollars to longer-service associates.

Grandfathering in pension de-risking. In recent years, employers have sought to mitigate risk in their traditional pension plans with an array of strategies that include liability transfer, reducing or eliminating future benefits, or ultimately, plan termination. By striking a more even balance between benefit security and cost, cash balance plans are often the best choice for a replacement plan or for providing grandfathering protection to those who would otherwise suffer unacceptable “haircuts” under a benefit freeze or plan termination.

Effective vehicle for smaller employers. The advantages of cash balance plans for small, closely-held business are well-known. In those situations, they provide a path that can expand benefits and offer tax advantages well beyond those afforded by a stand-alone 401(k) plan. This can help a business owner not just from a tax standpoint, but also as a way to bolster retirement benefits that took a back seat to building the business in earlier times.

Summary No single brand of retirement vehicle is inherently superior to another. The choice depends on the employer, driven by their specific human resource and financial objectives. Many employers though have found cash balance plans to be the best route, particularly small employers looking to enhance their programs, or other employers seeking to balance risk, benefit security, and cost.

Senior Vice-President

Retirement Consulting Practice Leader

McGriff Insurance Services EVaughn@McGriffInsurance.com

336-291-1142